Can i borrow 5 times my salary for a mortgage

Using Teacher Mortgage lenders that offer fantastic exclusive deals. The solicitor or licensed conveyancer handling your paperwork will contact your lender for a redemption statement and repay the outstanding loan amount to them out of your.

Pin On Mortgage Choice Jody Shadgett West Torrens

If you choose to use lenders mortgage insurance to increase your borrowing power you can choose to add it to the loan balance though keep in mind this means youll pay interest on it.

. However regulatory restrictions limit banks to having no more than 15 of their mortgage loans above the 45x multiple. You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price. Lenders mortgage insurance is an insurance cover that protects a lender if you cant meet required mortgage repayments and default on your loan.

Based on my salary from last year but can I use the EIDL funds to pay a newly hired employee. I mean what if I have an outstanding payment to make can I take 10 000 and but it back without any penalty. To borrow more than this you will need to use a mortgage broker to access specialist lenders.

Best of both worlds. Working out whether to invest or overpay your mortgage doesnt have to be an eitheror choice. To achieve this were providing you with direct access to the best financial information tools products and services that Australia has to offer.

In rare cases lenders may loan up to 5 times the borrowers annual salary. If you can borrow or buy into a membership to a bulk retailer like Costco it can make real financial sense. As a requirement you must make a 5 deposit and obtain a mortgage to shoulder 75 of the loan.

25 lakh and get instant approval. What happens to my mortgage when I sell my home. How much is my mortgage going up by.

For the first 10 years of a 30-year mortgage you could be paying almost solely on the interest and hardly making a dent in the principal on your loan. How Much Mortgage Can I Afford if My Income Is 60000. In the majority of cases unless you are porting it the mortgage on your existing home is redeemed paid off when you sell.

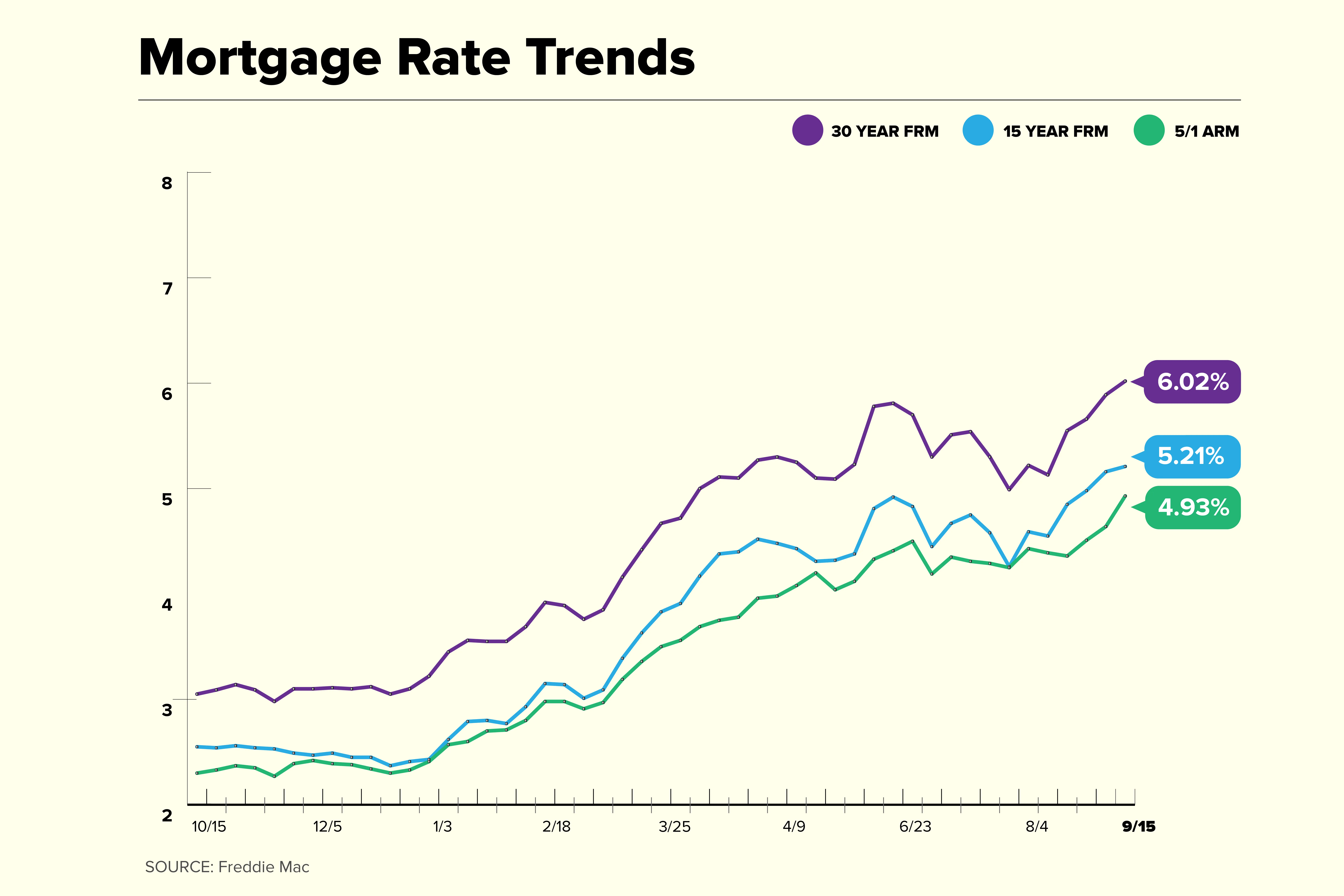

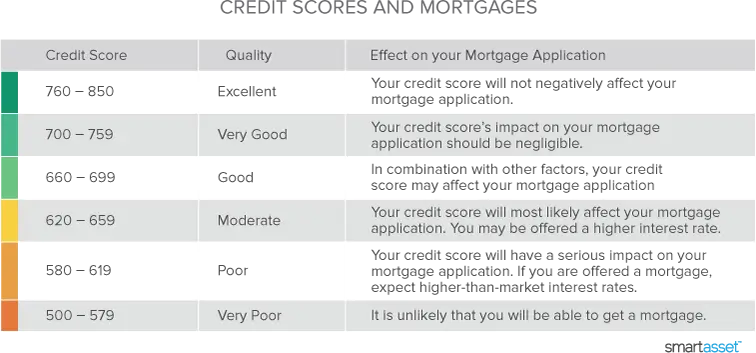

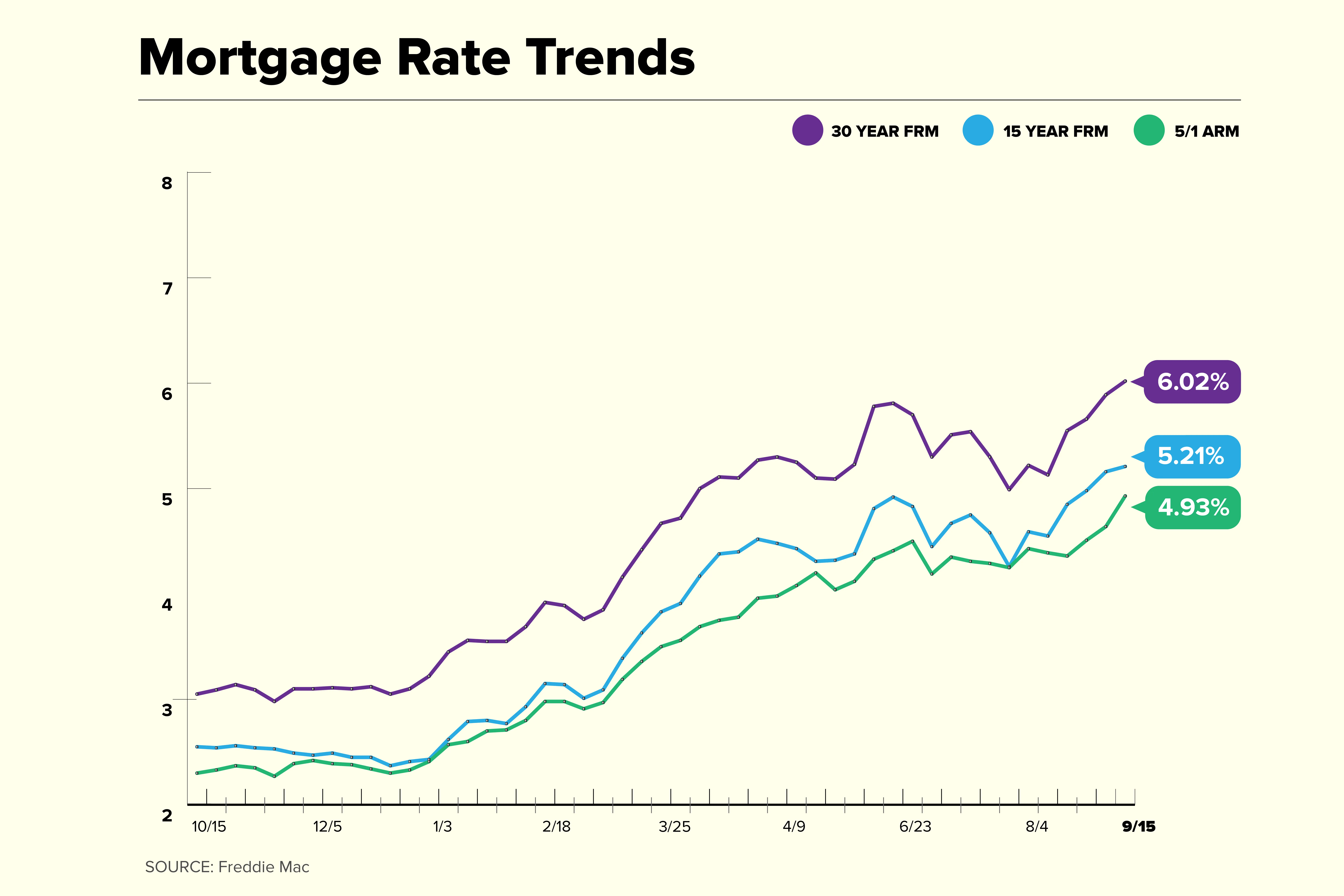

This is based on 45 times your household income the standard calculation used by the majority of mortgage providers. If youre reading this you are likely a Teacher that is having difficulty with their mortgage. In the case of a 30-year mortgage depending of course on the interest rate the loans interest can add up to three or four times the listed price of the house yes you read that right.

About Teacher Mortgages - UKs Leading Teacher Mortgage Broker. Borrow from her 401k at an interest rate of 4. At 60000 thats a 120000 to 150000 mortgage.

Borrow from the bank at a real interest rate of. The house must also be bought from a builder recognized by the program. Her cost of double-taxation on the interest is 80 10000 loan x 4 interest x 20 tax rate.

Even though income hasnt been the key lending criteria for banks. If you bring down your mortgage repayments you could use the money saved each. Fortunately theres a range of mortgage loans from government-assisted loans to the conventional fixed-rate type designed for people with various financial needs.

In these cases lenders can be selective and only choose borrowers with low debt loads that can afford a substantial deposit. With an online personal loan from Bajaj Finserv you can borrow up to Rs. Nearly everyone wants it but few people actually know what they need to do in order to get it.

Meet the easy-to-meet eligibility parameters and complete your basic documentation to avail the money you need within 24 hours of approval. A typical homeowner with a 400000 mortgage on a tracker rate will see their monthly payments jump by 99 or 1188 a year. Most lenders would consider letting you borrow.

And if so can I start. This article has been viewed 7635066 times. Or 4 times your joint income if youre applying for a mortgage.

If I received 31800 can I borrow from that money and later replace it. In most circumstances we can help you borrow up to 5 times your gross annual salary. The equity loan scheme finances the purchase of newly built houses.

The usual rule of thumb is that you can afford a mortgage two to 25 times your income. 55x your salary if you earn 75K or 100K on a joint application if youve got a 15 deposit to borrow up to 2M How many times my salary can I borrow The idea that mortgage lenders use a secret salary-multiplier formula is that UK borrowers are reluctant to let go. Find out what you can borrow.

At My Money Sorted our goal is to make life easier for 5 million Aussies by helping them make better money decisions achieve their biggest goals and secure the things they care about most in life. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. In some cases you can find brand-name products for sale at serious discounts.

Can an EIDL Cover My RentMortgage. You can borrow money and repay it in a series of small instalments over a period of time.

How Much A 250 000 Mortgage Will Cost You Credible

1

1

1

5 Ways To Get A Mortgage Even If You Don T Meet Income Requirements Gobankingrates

Families Struggle To Afford College Realclearpolitics College Costs College Private School

5 Times Salary Mortgage Lenders Who Offers Them Mortgageable

How Much Mortgage Can I Afford Smartasset Com

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

How Much House Can I Afford Calculator Money

5 Year Fixed Mortgage Rates And Loan Programs

Printable

5 Surprising Income Types Mortgage Lenders Allow

How Much House Can I Afford Fidelity

Agbo5fvxuoyi1m

Can I Get A Mortgage With Low Income Haysto

Low Income Home Loans And Mortgages Nextadvisor With Time